Unmasking the Mysterious World of Proxy Servers: Guarding Against DDoS Attacks and More!

Curious about the power of proxy servers? Get ready to unveil the secrets and learn why proxy servers are a must-have tool in your online arsenal!

Google Versus Microsoft - Which is the Better Collaboration Tool?

Both Google and Microsoft offer robust collaboration tools that cater to different needs and preferences. But which is better? That depends...

The Advantages of URL Schema

In this blog post, we'll explore URL schema, also known as URI scheme. It plays a crucial role in defining the structure and functionality of URLs, and offers several advantages.

Embracing the Future: Exploring the Revolutionary AI Technologies

Artificial Intelligence (AI) technologies have captured the world's attention with their transformative potential.

Navigating the Cookie Jar: A Guide to Privacy Compliance

Dive into the complex world of cookies and privacy compliance with our comprehensive guide.

The Ultimate Guide to Choosing the Best Web Hosting: Don't Settle for Less!

Where did Timmy go and what happened to his blogging? I was busy with a new hosting platform, and thought, what are key factors to consider, including performance, security, scalability, and support? Let's explore!

The Ultimate Guide to DNS SEC: Why It Is Important for Your Website?

In this article, we'll cover everything you need to know about DNS SEC, including what it is, how it works, why it's important for your website, and how to implement it. So, let's get started!

EEAT and YMYL: How They Affect SEO

In this blog post, we'll explore what EEAT and YMYL are and how they affect SEO.

The Ultimate Guide to MTA-STS Deployment: Is It Worth It?

In this blog post, we explore whether it's worth deploying MTA-STS and why. We discuss its benefits, when not to deploy it, and how to deploy it.

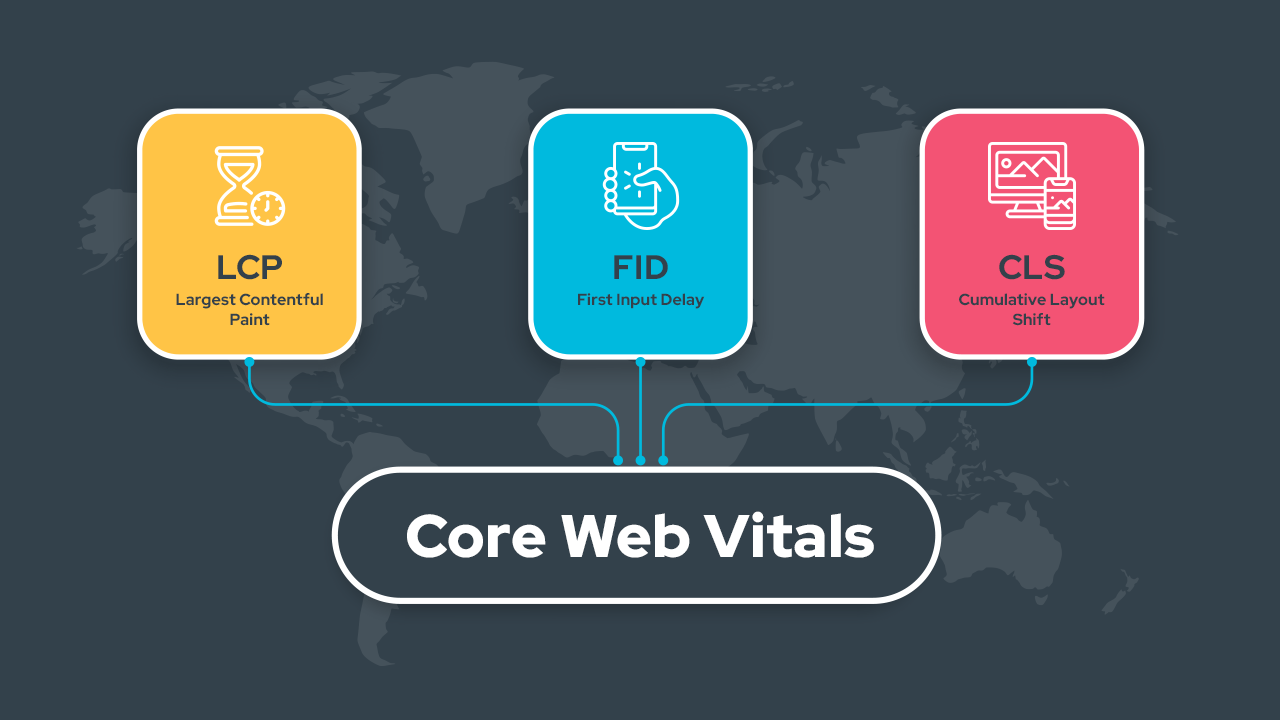

How to Optimize Your Website for Google's Core Web Vitals: A Digital Marketer's Guide

As a digital marketer, optimizing your website for Core Web Vitals is crucial to improve your SEO ranking and attract more traffic. In this guide, we'll explain what Core Web Vitals are, why they matter, and how to optimize your website for them. Let's dive in!

Exploring the Wonders of a Headless Server for Beginners

Interested in headless server technology but don't know where to begin? Our beginner's guide covers everything you need to know, from what it is to how to set it up, and best practices for running it.

Revolutionizing Website Aesthetics in 2023: Top 5 Design Trends to Watch Out For

Welcome to our latest blog post where we explore the top 5 website design trends that are set to revolutionize the digital landscape in 2023. Web design has come a long way, from basic HTML pages to the sophisticated and visually stunning websites of today.

What is Google Analytics 4?

Are you struggling to understand the behavior of your website visitors? Do you want to know what pages of your website are getting the most attention from your visitors?

The Ultimate Comparison of Tech Stacks: JAMstack vs. LAMP Stack vs. MEAN vs. .NET

This blog post offers a detailed comparison of the four most popular tech stacks used in web development - JAMstack, LAMP Stack, MEAN, and .NET. It compares them based on their architecture, scalability, performance, security, cost, and other critical criteria.

The Advantages of Using Bootstrap to Build a Website

Bootstrap is one of the most popular front-end development frameworks that provide a variety of tools and resources for building responsive and dynamic websites. Bootstrap has evolved to become a widely adopted tool for web developers, with its numerous advantages in making website development easy and efficient.

Mobile Application or Progressive Web App: Which is the Best Choice?

In this article, I'll explain the differences between native mobile applications and progressive web apps and help you decide which one is right for your business. I'll also explore the development process, user experience, accessibility, maintenance, and cost.

A Comprehensive Guide to Effective Server Patching Tactics

This comprehensive guide explores various effective server patching tactics to help you streamline your patch management process and keep your systems secure. Discover the importance of server patching, types of server patches, best practices for patching, common patching challenges, tools for effective patching, and more.

Keep content relevant, short, iterative and engaging

As the saying goes, content is king. It seems this trend will continue this way for some time, as marketers notice ongoing impact on building awareness, increased customer engagement, as well as lead quantity and quality.

The Importance of Performing Penetration and Application Scans on Your Website

In this blog post, Timmy Bohlman discusses the importance of performing routine penetration and application scans on your website. He explores the benefits of these scans, including compliance with regulations, protection against cyber-attacks, and reduced downtime.