Americans Trust Their Financial Institutions for Tax Advice

As the old saying goes, there's nothing in the world more certain than death and taxes. Many people consider taxes little more than a yearly chore, and many others know little about how the process really works, especially after the Tax Cuts and Jobs Act of 2017 introduced a number of serious rule changes.

Taxes can be a headache, and not all taxpayers fully understand how the new changes will affect them. The impact of the TCJA presents an excellent opportunity for credit unions to offer financial education in a meaningful and effective way. Many members already turn to their credit unions for assistance on financial matters.

Be a guide

Credit unions find themselves in a good position to not only guide members through how tax reform will impact their filing, but also highlight other financial education tools that may be available.

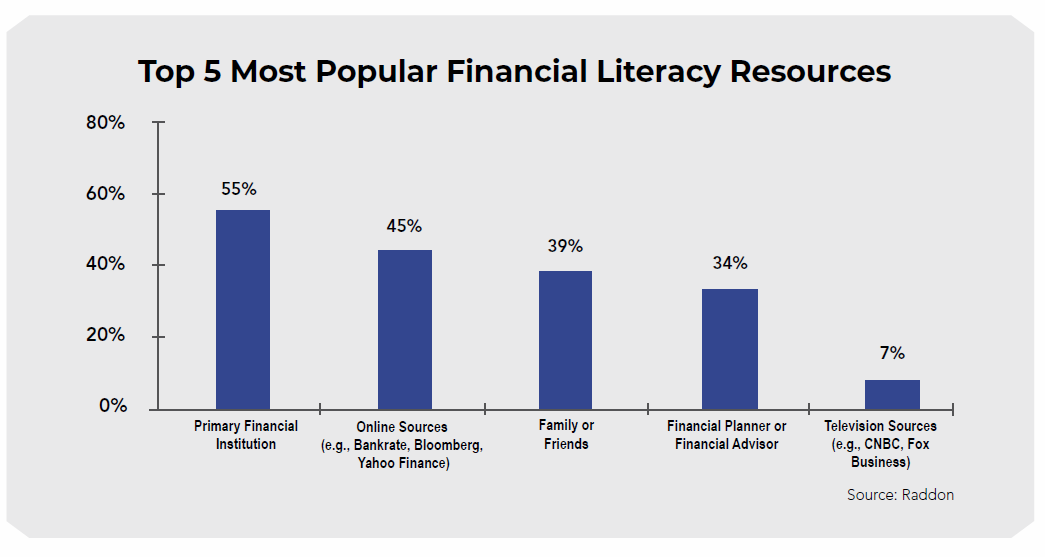

According to a 2018 survey from Raddon, Americans view their financial institution as the first source of financial literacy, ahead of online resources, family or friends, and other financial planners or advisors. Credit unions have built this great reputation by offering members an abundance of resources, and financial literacy programs have a remarkable effect on increasing member engagement and trust. However, are credit unions providing enough support before and during tax season? Credit unions cover a wide array of useful topics, but the problems their members have may not be the problems that a credit union anticipates.

Consider these popular questions for the next tax season:

- Should I hire someone to prepare my taxes or can I do it myself?

- If I complete my own taxes, what software should I use?

- Is an online application better than a desktop one?

- Should I file electronically?

If your members are coming to you for help with their tax questions and you don’t have a full line-up of resources, now is the perfect time to investigate how you’ll be able to support them through the 2019 tax season.

« Return to "CUSG Blog Corner"

- Share on Facebook: Americans Trust Their Financial Institutions for Tax Advice

- Share on Twitter: Americans Trust Their Financial Institutions for Tax Advice

- Share on LinkedIn: Americans Trust Their Financial Institutions for Tax Advice

- Share on Pinterest: Americans Trust Their Financial Institutions for Tax Advice