Credit Unions Have an Opportunity to Help Their Members Through Tax Season

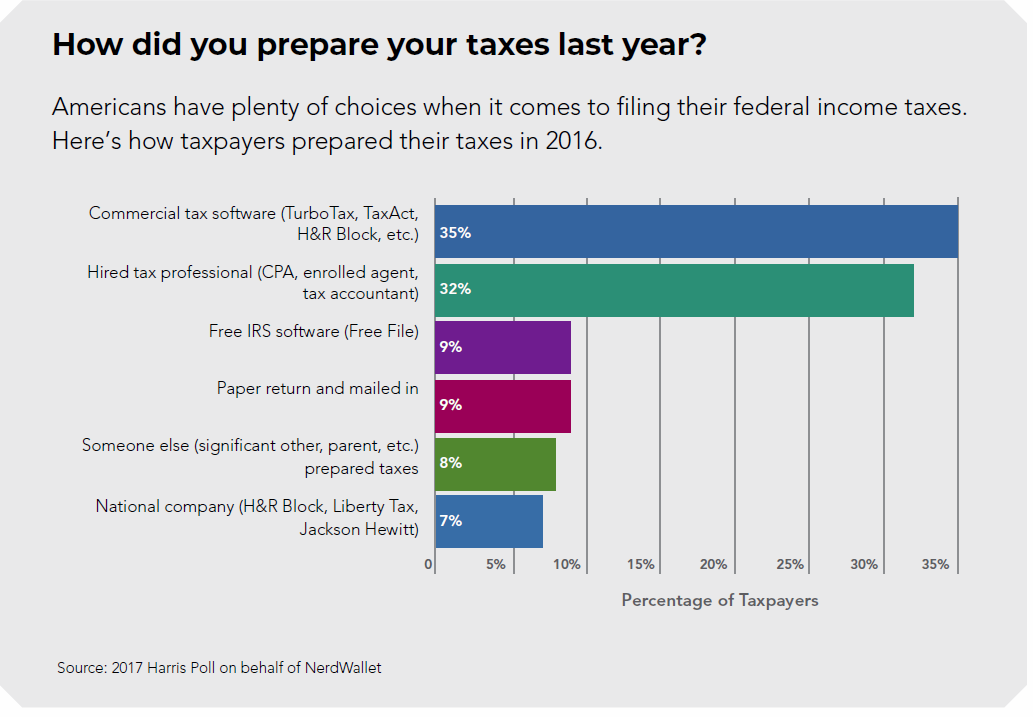

The vast majority of tax returns in the U.S. are filed online, using tax preparation software such as the highly popular TurboTax. There’s a reason most Americans turn to tax professionals and software for help, and that’s because knowing the intricacies of the American tax code is hard. What’s tax deductible and what isn’t? Can you write off gambling losses or loans to a friend? How do freelance workers file taxes? While these questions may seem basic to some, many Americans simply do not have enough confidence in their own knowledge to tackle taxes with pen and paper. According to a 2015 survey by NerdWallet, a survey of over 1,000 people across the U.S. found the average adult only got about 50 percent of the questions right on a basic tax test.

A more recent study, also by NerdWallet and conducted by the Harris Poll in 2017 with over 1,800 respondents, found that American adults answered only one in four questions correctly. Roughly 39 percent of taxpayers don’t even know what tax bracket they are in, and seven percent don’t even know what a tax bracket is! It’s no wonder taxpayers feel more comfortable approaching a tax professional or purchasing software to help them with their tax returns.

Credit unions can help

Credit unions can help taxpayers by providing basic tax education, much like the financial education programs many credit unions already offer. According to NerdWallet, 26 percent of Americans do not know how new tax reform rules will be impacting their tax returns, and about half of all taxpayers don’t know about the changes in the tax brackets. This is a chance for credit unions to help their members and guide them through some of the confusion when tax season hits.

Members trust their credit unions and look to them for help. According to a 2018 Raddon financial literacy study, 55 percent of respondents saw their primary financial institution as their top resource for advice and education. Credit-sensitive consumers and millennials are especially appreciative of financial literacy programs, and these two groups are also the most likely to bring more business to the institution if such programs are available.

Credit unions are well positioned to bring more value to their members by providing tax advice and education. These programs work to drive members into acquiring additional financial products, but also serve to benefit the community as a whole.

« Return to "CUSG Blog Corner"

- Share on Facebook: Credit Unions Have an Opportunity to Help Their Members Through Tax Season

- Share on Twitter: Credit Unions Have an Opportunity to Help Their Members Through Tax Season

- Share on LinkedIn: Credit Unions Have an Opportunity to Help Their Members Through Tax Season

- Share on Pinterest: Credit Unions Have an Opportunity to Help Their Members Through Tax Season