Is Your Credit Union Supported by the Four Pillars of Digital Banking?

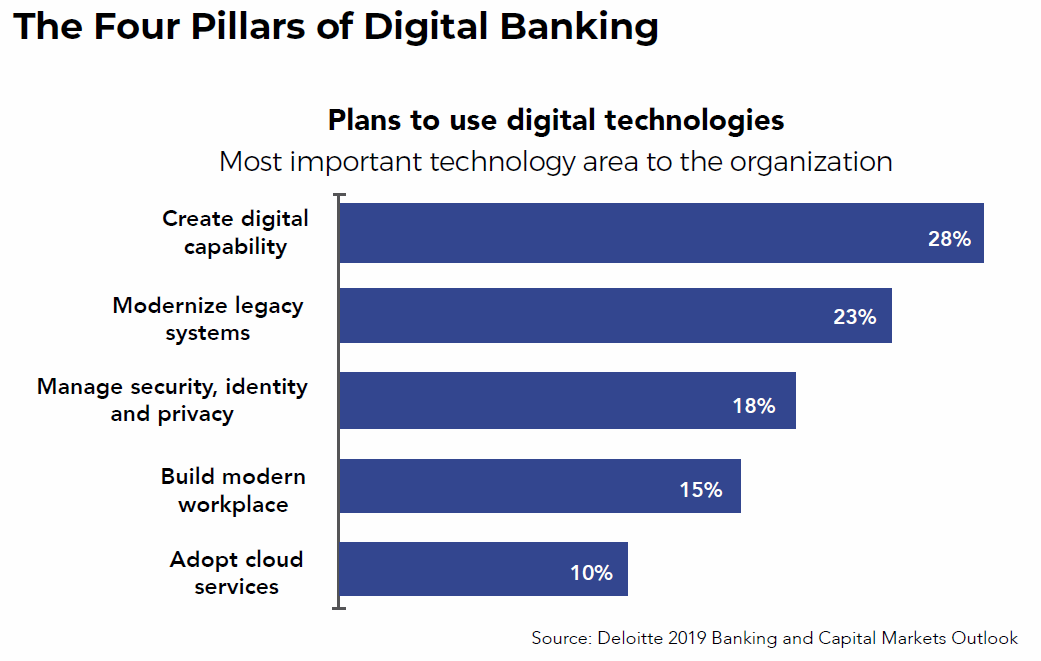

Enhancing an organization’s digital capability is the number one technology concern for many financial institutions, and many have made great progress. However, fintech and bigtech firms are challenging traditional institutions to not only look at technology differently, but to also look at the ways they interact with their members.

In order to succeed, credit unions must embrace the four pillars of digital banking and look for ways where they can reduce friction with members.

Mobile

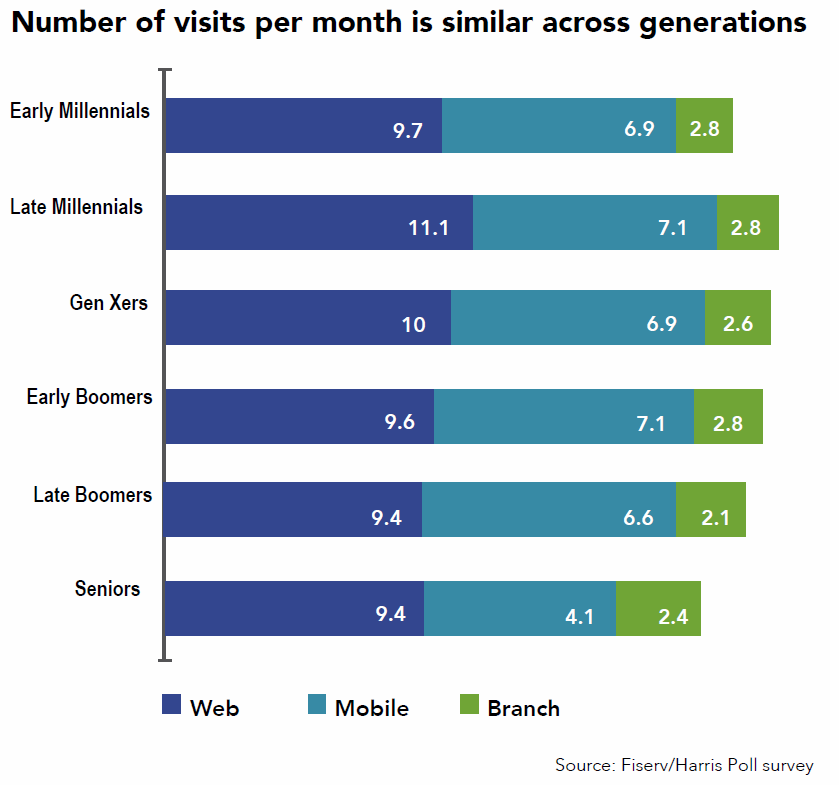

Web developers talk a lot about building for mobile first, but they’re not the only ones. The modern credit union also needs to apply the same mobile-first philosophy to their omnichannel delivery. Neo-banks and challenger banks have dominated the mobile-first banking space in recent years, eschewing physical branches for faster, easier mobile options with better rates. Mobile banking also attracts younger members (younger millennials and gen z) as well.

Fintechs are very sensitive to any design or authentication elements that prevent consumers from having a quick, streamlined mobile experience. Consumers are quick to abandon a mobile activity if the process takes too long: they become frustrated with authentication measures or technical issues, or they become distracted. According to a recent survey from Jumio, roughly a third of customers report having a negative reaction to their financial institution after abandoning a mobile banking activity. Millennials, the generation with the most preference for mobile banking, is also the quickest to drop it if they are not satisfied. Jumio found that 43 percent of millennials have abandoned a mobile banking activity, as opposed to only 25 percent of Gen X and 13 percent of baby boomers.

Online

Online banking remains the bread and butter for many financial institutions, and many are working on refining and improving their online experience for members, specifically in how they can make banking more consumer-centric. Having secure access to online accounts remains the most important priority across all age ranges, but consumers, especially millennials, are demanding more utility out of their online banking, specifically regarding ease of use, good website design, easy ways to transfer money and quick account opening.

Omnichannel lending

Credit unions that do not currently have integrated mobile and online lending are at a tremendous disadvantage to institutions that do, as well as non-traditional lenders like LendingTree and Lending Club. Peer-to-peer and marketplace lenders typically offer competitive rates, very fast turnarounds, lower fees and excellent utilization of the technology available to them, especially when it comes to loan automation.

Non-bank lenders are fragmenting the market and increasing the demand for fast, easy-to-understand lending services that have since expanded to areas where traditional financial institutions have been dominant. Many consumers still perceive taking a loan from a bank or credit union to be a slow, oblique and exhaustive process. Why would consumers, especially those in need of urgent loans, seek a credit union over a quick online lender with competitive rates?

According to the 2017 Small Business Credit Survey, conducted by a collaboration between the 12 Federal Reserve Banks, the number of applications to online lenders is rising due to the speed of credit decisions, improved chance of funding and lack of collateral requirements. Satisfaction with online lenders also increased from 19 percent in 2015 to 35 percent in 2017.

Account opening

Consumers expect new account openings to take a minimum amount of time. In some surveys, this means less than 15 minutes before they abandon the process — and possibly look at what other financial institutions offer. According to a recent Javelin Research study, 90 percent of consumers abandon online account applications.

The three primary obstacles to onboarding new accounts:

- Difficulty or inconvenience in switching accounts

- Obstacles or delays enrolling in online banking

- Struggles in switching direct deposits and bill pays

Credit unions can begin to address these issues by offering:

- Easy ways to save and resume the account-opening process. Just because a potential member abandons the process does not necessarily mean they will not return. Many consumers “test” an application by filling out a few fields and then naturally assume that their progress has been saved. If this is not the case, they may become frustrated and drop the application for good.

- Easy and secure authentication. Security is very important to consumers of all ages and is usually considered the top priority for online banking, followed by convenience. Attempting to combine security and convenience can be difficult, as one naturally hinders the other. However, there are many authentication processes now considered standard, such as multi-factor authentication, that are more readily accepted by consumers. As always, biometrics is popular with consumers as well.

- A consistent process across many channels. Some members may prefer to open an account on the go through their mobile device; others may prefer a desktop or tablet. Ensuring that the process is consistent and technically sound is a must, but consumers also want the ability to continue where they left off, even if it’s on a different device.

- A way to show progress. Giving consumers an indication of how long the process is, as well as where they are in that process, will relieve frustration and prevent abandonment of a process for being perceived as too lengthy.

All credit unions need to review and improve their processes when it comes to the four pillars of digital banking. A financial institution without mobile and online banking, automated lending and efficient and intuitive account opening methods will find it more than hard to compete in the current marketplace — they will find it nearly impossible.

« Return to "CUSG Blog Corner"

- Share on Facebook: Is Your Credit Union Supported by the Four Pillars of Digital Banking?

- Share on Twitter: Is Your Credit Union Supported by the Four Pillars of Digital Banking?

- Share on LinkedIn: Is Your Credit Union Supported by the Four Pillars of Digital Banking?

- Share on Pinterest: Is Your Credit Union Supported by the Four Pillars of Digital Banking?