Why HR Should Take Advantage of Employee Self Service

The technology available to HR has come a long way in recent years, and while many organizations are looking toward cutting-edge innovation and automation, credit unions should first ask themselves if they are making the best use of the resources they have at hand. One of the technologies available to HR are employee self-service (ESS) tools. Utilized correctly, self-service tools can save your HR team time and resources that can be better spent on other important priorities, such as strategic planning. Another powerful benefit of ESS is the convenience it provides for employees, making it easier to access information, whether at the workplace or at home.

What’s new with ESS?

At its core, self-service tools have remained consistent — software that allows employees to complete basic administrative tasks themselves. Tasks such as:

- Viewing W2 and tax-related information

- Viewing payroll information

- Managing time off

- Viewing work schedules

- Updating financial information

- Changing personal information

- Receiving and delivering information from HR as both a former and current employee

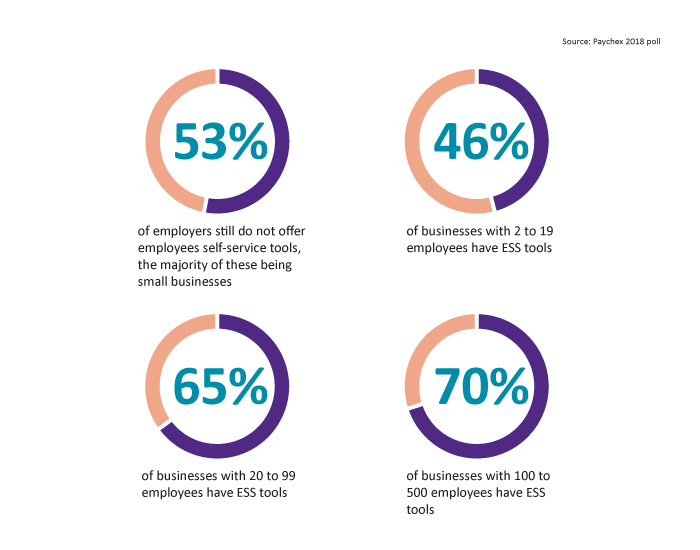

As the technology becomes more advanced and more affordable, ESS is also becoming more accessible to smaller organizations. Many companies are now moving beyond treating ESS tools as a convenience for employees and time saver for HR and are turning it into an employee experience enhancer. Employees are more than happy to hop on the bandwagon. According to a recent Paychex survey, 73 percent of employees say they expect their employers to provide self-service tools.

Furthermore, innovators are looking past just basic ESS and toward what leading industry analyst Josh Bersin terms “intelligent self-service.” In addition to filling out forms, deciding between benefits or viewing pay stubs, intelligent ESS is pioneering technology to answer employee questions and complete more complex transactions, using intelligent assistance programs such as Alexa or Google Assistant.

Empowering employees with technology

ESS empowers employees by giving them the ability to do more. Instead of having to meet with HR for everything, employees can now manage their own administrative tasks. This leads to the benefit of expediting the onboarding process and making it easier for employees to keep track of time and attendance, choose benefits, access payroll and even begin training. With these tasks available at their fingertips, employees are encouraged to spend their time with HR as more of a dialogue rather than something that is merely transactional.

Organizations are now looking at improving this dialogue to make communication more reciprocal, increasing employee engagement and contentment. Taking full advantage of ESS tools is a crucial part of this evolution.

« Return to "CUSG Blog Corner"